In this article, we will look at the best debt consolidation loans companies of 2024 and walk you through the process of selecting the best option to help you manage your debt.

We’ll talk about the best debt consolidation loans, how they work, and how they can help you save money. From understanding the advantages of lower interest rates to comparing loan options, this comprehensive guide will provide you with everything you need to make an informed decision.

Whether you want to simplify your payments or lower your interest rates, our guide will cover the important factors to consider when choosing a debt consolidation loan.

Let’s get into the details and help you find the best financial solution for your situation.

Table of Content

- Best Debt Consolidation Companies of 2024

- What are Debt Consolidation Loans?

- How Debt Consolidation Loans Work?

- How Debt Consolidation Can Save You Money?

- How to Compare Debt Consolidation Loans

- How to get a Debt Consolidation Loan

- Where Can I Find the Best Debt Consolidation Loan Rates?

- The Federal Reserve’s Influence on Debt Consolidation Loan Rates

- Debt Consolidation vs. Other Debt Relief Options

- When is a Debt Consolidation Loan a Good Idea?

- Does Debt Consolidation Hurt Your Credit?

- Calculate Your Potential Savings from Debt Consolidation

- Alternatives to Personal Loans for Debt Consolidation

- Is Debt Consolidation a Good Idea?

- Ways to Consolidate Debt Without a New Loan

- Conclusion

- FAQs about Best Debt Consolidation Loans

Best Debt Consolidation Loans Companies of 2024

| Company | Finance Prosper Rating | Minimum Credit Score | APR Range | Loan Amounts | LEARN MORE |

|---|---|---|---|---|---|

SoFi® SoFi® | 5.0 | 650 | 8.99% to 29.99% | $5,000 to $100,000 | Compare Rates |

4.9 | 580 | 8.49% to 35.99% | $1,000 to $50,000 | Compare Rates | |

4.4 | 640 | 11.72% to 17.99% | $5,000 to $40,000 | Compare Rates | |

4.4 | 600 | 8.98% to 35.99% | $1,000 to $40,000 | Compare Rates | |

Discover Discover | 4.2 | 660 | 7.99% to 24.99% | $2,500 to $40,000 | Compare Rates |

4.2 | 580 | 11.69% to 35.99% | $1,000 to $50,000 | Compare Rates | |

PNC Bank PNC Bank | 4.1 | Does not disclose | Rates may vary by ZIP code | $1,000 to $35,000 | Learn More |

3.7 | 640 | 8.99% to 35.99% | $2,000 to $50,000 | Compare Rates |

What are Debt Consolidation Loans?

A debt consolidation loan is a type of financing that consolidates multiple debts, typically high-interest credit cards, into a single new loan with a fixed payment. Debt consolidation loans can save you thousands of dollars in interest by consolidating debts rather than making minimum payments on multiple variable interest rate credit cards. This is particularly true if you can obtain a lower interest rate.

Selecting the debts you wish to pay off is the first step in the debt consolidation loan process. Next, you must meet the lender’s eligibility requirements. Obtaining the best rates requires having a high credit score.

The lender will deposit your funds in your bank account or send them directly to your creditors. Once the loan is paid off, you will make payments according to the terms you chose.

How Debt Consolidation Loans Work?

Lower Interest Rates: Consolidating debt only makes sense if the interest rates on your new credit card or loan are less than the interest rates on the debts you’re trying to settle. To maximize your overall savings, prioritize consolidating debts with the highest interest rates first.

Shorter Loan Terms: Keep the loan term as short as possible. You may be offered a longer loan term. While this may appear to be a cheaper option in the short term, you will end up paying more in interest over time.

Fixed Rates: Many debt consolidation loans are fixed-rate, meaning that each month you make the same payment and the interest rate is fixed. Thus, you could use a debt consolidation loan to pay off your three credit cards, each of which has a different interest rate and minimum payment. Instead of managing three monthly payments, you would only have to handle one.

How Debt Consolidation Can Save You Money?

Just imagine you have three credit cards with different minimum payments and interest rates. You could get a debt consolidation loan to pay those off. You’d only need to remember one monthly payment instead of three. Here’s how a debt consolidation loan can save you money on interest payments.

Credit Card Details:

- Card 1: Balance of $5,000 with an APR of 20%

- Card 2: Balance of $2,000 with an APR of 25%

- Card 3: Balance of $1,000 with an APR of 16%

Interest Costs Without Consolidation: The interest you would pay on these credit card balances would come to $927 if you paid them off over a year.

Interest Costs With Consolidation: Let’s say you take out a $8,000 personal loan with a 12-month term and a 12-percent annual percentage rate. If the loan is repaid in a year, the interest paid will only total $711.

Use a credit card payoff calculator and a personal loan calculator to figure out how much you could save through consolidation.

How to Compare Debt Consolidation Loans

There are numerous factors to consider before selecting a specific lender. Here are some key points to consider when comparing lenders.

- Determine Loan Amounts Offered The maximum or minimum amount you can borrow varies by lender. Add up the balances of all the credit cards you want to consolidate to ensure you apply for enough to meet your needs.

- Understand Approval Criteria Lenders consider your credit score, income, and debt-to-income ratio, among other things, when evaluating loan applications. Some specialize in bad credit debt consolidation loans but charge higher rates and fees, whereas excellent credit lenders typically offer low rates for high credit scores.

- Compare Interest Rates Different lenders advertise varying annual percentage rates (APRs). The annual percentage rate (APR) is the annual cost expressed in percentages. It combines the interest rate with any fees. The lowest advertised rate is never guaranteed; your actual rate is determined by your credit.

- Look for fees While some lenders do not charge additional fees, keep an eye out for late fees, origination fees, and prepayment penalties. Consider these when calculating how much money you need to borrow.

- Examine the Payments for Various Loan Terms Most lenders that specialize in debt consolidation offer terms of one to seven years for repayment. You receive the lowest payment, but at a higher rate, over a longer term. A shorter term will usually result in a lower rate. Your monthly payment will be higher with a shorter term, but you will save a ton of money on interest.

How to get a Debt Consolidation Loans

Whether you have bad or good credit, the process for obtaining a debt consolidation loan is the same. With a higher credit score, you will be more likely to qualify for a debt consolidation loan.

1. Add Up the Balances of All Debts You Want to Combine

Check your current statements for the most accurate figures, and add a few hundred dollars for interest that will accrue while you wait for your debt consolidation loan to be funded. It is easier to reduce your loan amount than to increase it once approved.

To get an idea of how much you could save and what your new payment would be, use a debt consolidation calculator.

2. Check Your Credit Scores

The borrowers with the highest credit scores receive the lowest advertised debt consolidation APRs. That is not to say that you cannot benefit from a debt consolidation loan if you have bad credit. As your credit score improves, you may need to refinance your debt consolidation loan to save even more money.

3. Compare Loan Options by Prequalifying with Several Lenders

Most debt consolidation lenders provide a prequalification option, which allows you to get an idea of the terms and APRs you might be eligible for without negatively impacting your credit score. Review the APRs, terms, and fees to determine which option is best for you.

4. Apply with the Debt Consolidation Lender You Choose

You will apply for your loan online unless you do business in person at your neighborhood credit union or bank. The lender will gather data such as pay stubs, employment history, and past few years’ worth of address history. In order to verify your credit score and determine the amount of additional debt you have, your credit will be pulled.

The lender may decide to lower your loan amount, raise your interest rate, or do both if your credit score turns out to be lower than you anticipated or if you have too much debt for your income. You might want to think about other debt consolidation options if you are denied approval.

5. Finalize Your Paperwork, Receive Funds, and Pay Off Your Debts

After your approval is complete, send the lender any more documents they ask for. While some debt consolidation lenders pay your creditors directly, others provide you with the money so you can settle your debts independently.

Where Can I Find the Best Debt Consolidation Loan Rates?

Banks: Banks typically provide the lowest interest rates on debt consolidation loans, but to be eligible, you may need good or excellent credit (a score of 690 or higher). Before thinking about other lenders, if you already have a relationship with a bank, it’s worth finding out about their loan options and qualifying requirements.

Credit unions: Credit unions also provide lower-interest loans and may be more accommodating to borrowers with fair or poor credit (a score of 689 or lower). Before you can apply for a loan, you must first join the credit union, which is usually simple and inexpensive. You can usually complete the application online, and you may be required to make an initial deposit ranging from $5 to $25.

Online Loans: Online loans are available to borrowers across the credit range, which are often the most convenient option. Certain online lenders can approve loans right away and fund them the same or the following day. Many also allow you to pre-qualify, which means you can look into potential loan terms without affecting your credit score. Because online loans can be more expensive to borrow, it’s best to pre-qualify with several lenders and compare rates.

The Federal Reserve’s Influence on Debt Consolidation Loan Rates

Interest rates were originally predicted to fall in 2024, potentially lowering debt consolidation loan rates. However, this sentiment has since shifted due to persistently high inflation. The Fed is more likely to keep rates unchanged than to cut them in the near future.

Nonetheless, record-breaking interest rates did not deter personal loan borrowers in 2023. They borrowed an average of $11,281, the highest average ever recorded, according to TransUnion data. Borrowers with excellent credit turned to personal loans at a record pace last year, with originations up 20% from 2022.

Debt Consolidation vs. Other Debt Relief Options

Debt consolidation vs. Personal loan Loans

Personal loans are one of several debt consolidation options. These are installment loans with a fixed rate and repayment term. Certain lenders offer personal loans with the express purpose of consolidating debt. Debt consolidation loans typically have terms of one to seven years, with many allowing you to consolidate up to $50,000.

However, borrowers can use personal loans for more than just debt consolidation. Personal loans can be used for almost any purpose, including financing large purchases and home improvement projects.

Debt Consolidation vs. Debt Relief Loans

Understanding Debt Relief vs. Debt Consolidation Loans

Debt relief and debt consolidation loans are not the same thing, despite being frequently used interchangeably. Debt relief is essentially a catch-all term. Debt relief includes a variety of strategies for getting out of debt, including consolidation.

Evaluating Debt Relief Strategies: Benefits and Drawbacks

Each method of debt relief has benefits and drawbacks. Some debt relief strategies entail collaborating with a nonprofit credit counselor or for-profit businesses. A debt relief company may advise you on debt consolidation or creating a debt management plan.

When Debt Relief Strategies Fail: Exploring Other Options

If those strategies fail, or the customer has too much debt to handle in that manner, a debt relief company may recommend debt settlement or bankruptcy. These options have significant drawbacks, such as long-term damage to your credit score, and should be considered last.

When is a debt consolidation loan a good idea?

While a debt consolidation loan is an excellent repayment option, it will not change your spending habits. If your income suddenly drops or you incur additional debt, a fixed monthly payment may become burdensome. Weighing the benefits and drawbacks of debt consolidation will help you determine whether it is the best option for your finances.

Pros

- Interest Rates: Interest rates are fixed and typically lower than credit cards and payday loans.

- Simplified Payments: Instead of tracking multiple monthly payments, you’ll only need to keep track of one. Typically, no collateral is required, so your car and home are safe.

- Quick Access to Funds: Funds could be available in as little as one business day.

- Credit Score Improvement: Credit scores may improve after credit cards are paid off.

Cons

- Limited Terms: Maximum terms are typically limited to seven years, which could result in high payments.

- Higher Rates for Poor Credit: For borrowers with poor credit, rates might be greater.

- Non-Reusable Funds: Funds cannot be reused because they are paid off like credit cards.

- Origination Fees: Origination fees may reach a maximum of 12%.

- Prepayment Penalties: Prepayment penalties may limit how quickly you pay off the balance.

Does Debt Consolidation Hurt Your Credit?

Debt consolidation loans can have a negative impact on your credit, but only temporarily. Applying for a loan necessitates a hard credit check, which can cause a slight drop in your credit score. However, the inquiry’s impact on your score will gradually fade over time, typically disappearing after two years. Your credit score may also suffer if you take out a debt consolidation loan, pay off your credit cards, and then incur additional debt on those cards.

However, consolidating loans can be an excellent way to streamline your payments, lower your monthly debt service, and develop healthy financial habits by making regular, on-time payments. Furthermore, some lenders provide credit management tools in addition to traditional lending services.

Calculate Your Potential Savings from Debt Consolidation

Enter your current interest rates and outstanding debts to use the debt consolidation calculator. Once you have your estimated terms and monthly payment schedule, make the necessary adjustments to identify the best consolidation loan that fits your budget.

Current monthly payment: $1,000

New monthly payment: $544

Overall interest saved: $ 3,069

With your credit score, you’re likely to receive a personal loan with an APR of 11% and average term of 5 years.

Alternatives to Personal Loans for Debt Consolidation

If you’re not sure if a personal loan is right for you, you should consider the benefits and drawbacks of other debt consolidation options. You may be able to find debt relief assistance in a variety of ways, including alternative financing options and methods that do not require a loan.

Other options that involve borrowing

Balance transfer cards, home equity loans, home equity lines of credit, and peer-to-peer loans may be more suitable debt consolidation options for you. It all depends on how much debt you have, your credit score, and how quickly you want to pay off your balances.

Balance Transfer Cards

Balance transfer cards are credit cards that offer a 0% APR period. These introductory periods, which typically last 15 to 21 months, can be an excellent way to avoid interest if you repay the entire balance by the end of the period.

Pros

- Advantages include introductory rates as low as 0%.

- Faster than other debt consolidation loan types.

- There is no risk of asset loss because collateral is not required.

Cons

- Typical fees range from 3% to 5% of the transfer balance.

- After the intro period expires, the APR will be higher than on other loans.

- Your credit score may drop as a result of a hard credit pull.

Home Equity Loan

Home equity loans are similar to debt consolidation loans, but the balance is secured by the equity you’ve built up in your home. While this can result in lower interest rates, it also puts you at risk of foreclosure if you fail to pay your loan balance.

Pros

- A fixed monthly payment loan with a fixed rate.

- Repayment terms up to 30 years are offered.

- Lower interest rates compared to credit cards.

- Larger loan amounts.

Cons

- Risk of facing foreclosure on one’s home.

- To qualify, you must have home equity.

- Longer repayment terms may result in higher interest charges overall.

- Longer average funding turnaround time.

Home Equity Line of Credit (HELOC)

HELOCs, like home equity loans, are secured debts that use your home’s equity as collateral. They function more like a credit card, allowing you to withdraw as much as you need during the draw period. HELOCs are ideal for consolidating large amounts of debt over time, but they should only be used if you have enough income; if you fail to make the payments, you risk losing your home.

Pros

- Interest-only payment options for low monthly payments.

- Payments are based solely on the amount drawn.

- You can pay off and re-use the account as often as necessary.

Cons

- Risk of facing foreclosure on one’s home.

- Variable interest rate.

- The line is limited by the amount of home equity you have.

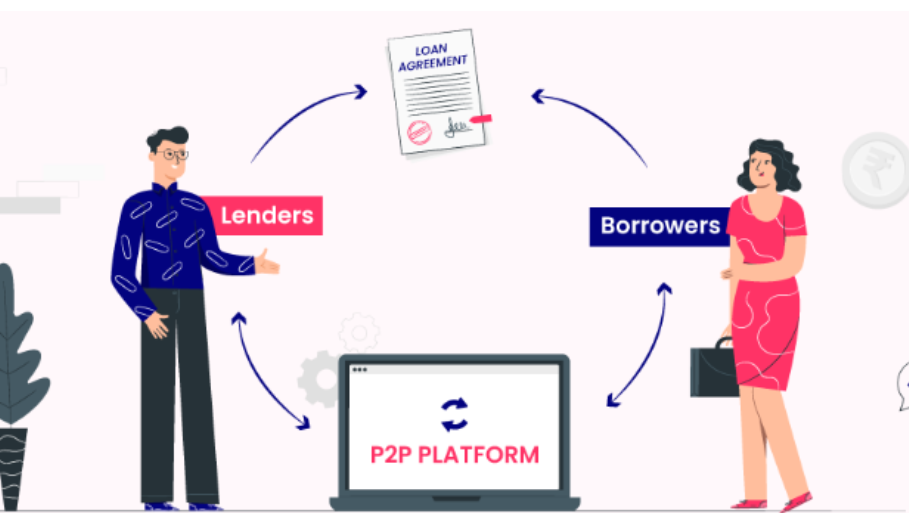

Peer-to-peer Loans

Peer-to-peer lending borrows from investors rather than traditional lenders or banks. These loans typically have lower credit requirements than debt consolidation loans, with some requiring scores as low as 600.

Pros

- Quick application.

- Approval and funding processes.

- Qualifying standards are more flexible.

Cons

- Fees that vary from 1% to 8% of the total loan amount.

- Higher interest rates compared to traditional lenders.

Is Debt Consolidation a Good Idea?

Debt consolidation is a good idea for you if you have a good credit score and are already working on improving your financial habits. Debt consolidation can help you if:

- You’re determined to repay your debt consolidation loan in full.

- Your cash flow is sufficient to pay off all of your debts.

- You don’t mind paying back your loans over an extended length of time.

- Since taking out your initial loans, your credit score has increased.

- You have a budget in place to make sure you don’t accumulate more debt.

Ways to Consolidate Debt Without a New Loan

The ultimate goal of any debt consolidation strategy is to become debt-free. If you do not qualify for debt consolidation loans, you may want to consider alternative debt repayment strategies.

Debt Management Plan

Debt management plans are not loans, but they can help you pay down your unsecured debt. You can create your own debt management plan or seek assistance from a credit counseling agency. If necessary, your credit counselor may negotiate your debts with creditors on your behalf, sometimes for a fee.

The Debt Snowball Method

The debt snowball method entails paying off credit accounts in order of smallest balances first, while making minimum payments on all other accounts. As you pay off small balances, you make room in your budget to pay down larger credit balance accounts until they are paid in full.

The Debt Avalanche Method

The debt avalanche method focuses on paying off your highest-interest debts first, then making minimum payments on everything else. Although it may take longer to pay off your debt in full, focusing on cards with higher interest rates first will save you money in interest payments.

Chapter 7 Bankruptcy

A Chapter 7 bankruptcy might be your only option if your financial condition is dire and you lack the resources to pay your debt. Consumers with incomes less than the state median may be eligible for this relatively quick bankruptcy option, which discharges most types of debt. However, you may lose assets such as a home or car.

Conclusion

Debt consolidation loans can help you manage your finances by combining multiple debts into a single payment. Securing a lower interest rate allows you to save money and reduce financial stress.

Explore your options carefully to find the best loan for your needs, and remember that effective debt management begins with understanding your options and making wise decisions.

FAQs about Best Debt Consolidation Loans

What is a debt consolidation loan?

A debt consolidation mortgage combines a couple of money owed into one mortgage, regularly with a decreased hobby price. It simplifies payments and might reduce month-to-month bills.

How do I find the great debt consolidation mortgage costs?

Compare fees from banks, credit unions, and online creditors. Check for expenses, loan phrases, and eligibility requirements to discover the nice choice for your wishes.

What is the distinction between debt consolidation and debt remedy?

Debt consolidation combines money owed into one loan, while debt remedy includes negotiating with creditors to lessen the full quantity owed or accept much less.

Can I consolidate debt without getting rid of a brand-new loan?

Yes, you can explore alternatives like balance transfers or negotiating with lenders directly, however, those methods won’t offer the identical blessings as a traditional consolidation loan.

What are the professionals and cons of debt consolidation?

Pros: Simplifies bills, may also decreases interest costs, and can reduce month-to-month payments.

Cons: May make bigger the mortgage term, ought to involve charges, and won’t address underlying spending troubles.