A target market for a bond loan would include low- and middle-income families interested in purchasing homes. Authorities at state and local levels issue bond loans as a way of subsidizing the cost of homeownership by either lowering interest rates on the loan or cash assistance to the borrower. Not so curious? No problem. we have you covered.

We can also help you find a financial advisor to advise you on how to fix your finances to get a conventional mortgage with good terms and rates. See a financial advisor if you’re not sure if a bond loan—or any other kind of loan—is the right choice for you.

What Is a Bond Loan?

Bond financing is a long-term borrowing method used by the state to raise funds for a variety of purposes. The state raises funds by offering bonds to investors. In return, it affirms to pay back this money, plus interest, on a specified schedule.

Qualifying for a mortgage is easier said than done for many low-income individuals and families, who are required to put quite a bit of income on the line. However, the government wants Americans to be homeowners rather than just renters. These government programs make it easier for low- to moderate-income families to buy their own homes. One such government program is the bond loans.

Mortgage Revenue Bonds and Their Role in Housing

Mortgage revenue bonds are one way that a state or municipality can finance programs that lower the cost of purchasing a home. A mortgage or collection of mortgages serves as collateral for mortgage revenue bonds. The money that funds the payments made to mortgage revenue bond investors is tax-free all comes from the interest payments made by the homeowners tied to these mortgages.

How Mortgage Revenue Bonds Help Make Homes Affordable

The money raised by mortgage revenue bonds issued is used by the government to lower the cost at which a home sold to residents who could otherwise not afford it sells. For this reason, bond loans are also referred to as mortgage revenue bond loans because they have partial backing from mortgages.

Government Support for Low-Income Home Loans

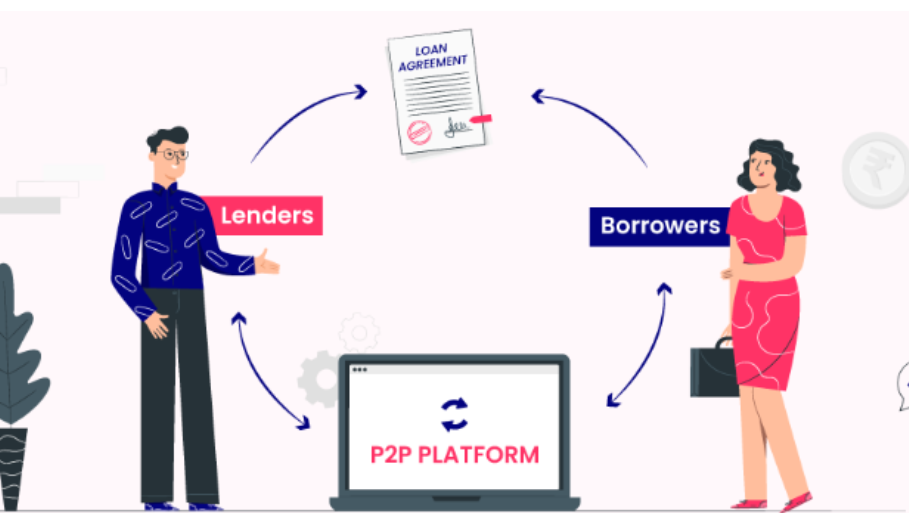

In other words, the government can tell a bank or other lender, “Please provide x number of home loans to individuals with y income; Those loans will be partially financed by public monies. If the government backs the loan, lenders who might have otherwise turned down low- and middle-class borrowers will interpret it as a green light to give home loans to borrowers who pose a greater risk.

Who Issues Bond Loans?

If you want to buy your first home using a bond loan, it’s not the local or state government that issued the bond you go to. Rather, it is a lender like a bank, housing finance authority, or affordable housing corporation. Not every low- or middle-income household will qualify for a bond loan. But tens of thousands of Americans have benefited from these loans.

Applying for a Bond Loan

In some cases, you may go directly to a participating bank. First, you must apply to the state- or locally-run real estate finance agency in charge of the bond loan program for the others.

Benefits of Bond Loans

There are many benefits of bond loans:

- If bond loans are available, and your income qualifies you, you’ll probably receive a better, which is to say lower, interest rate on your mortgage than you would if you simply applied for a standard home loan.

- Bond loans are partially insured by the government.

- This is supposed to encourage lenders to make home loans available to borrowers with limited or otherwise modest incomes.

- Government support also means that lenders can be able to give low interest rates, making a home purchase affordable.

- Sometimes the applicants for bond loans can get both a low interest rate and a chunk of cash to be able to help them with their down payment or closing costs.

Terms and Eligibility for Bond Loans

- Bond loans are usually taken as 30-year mortgages.

- This implies that in case you qualify, you will have until you pay off your loan in 30 years.

- And because of this, your interest rate will be low.

- Income requirements usually specify that your household income be no greater than 115% of the area’s median income, but rules may vary.

- In many programs you must be a first-time home-buyer to be eligible for a bond loan, but not everywhere.

Tips for Affordable Housing Findings

You should follow these tips if you want to find affordable houses:

- Perhaps you could not find a lender with a bond loan program offering fair terms in your locality.

- However, you are likely to benefit from one of the many programs for first-time homebuyers.

- Many such programs are insured or otherwise guaranteed by government agencies.

- Therefore, lenders offering such insured programs are more likely to give you a low-interest loan even if your credit score is not so good.

- A financial advisor can guide you through every step of this process.

- The process of finding a financial advisor is not a difficult one.

- With the help of SmartAsset’s free tool, you can choose from three local financial advisors by using a free consultation to determine which one is best for you.

- Get going right away if you’re prepared to find an advisor who can assist you in reaching your financial objectives.

Conclusion

Perhaps you believe you might be a candidate for a bond loan. First, do a little homework to find out whether there are bond loan programs available in your area. Not all lenders offer bond loan programs. Just ask your local bank, housing finance authority, or affordable housing corporation if they do.

It is always best to shop around until you find a lender you would like to work with. When you become a homeowner, equity in your home will be able to be built and your net worth will be grown.

FAQs

Why Mortgage Revenue Bonds Are Attractive to Investors

The benefits of mortgage revenue bonds, such as being tax-free and secure, make them attractive and risk-free for certain investors.

Could you take out a money bond?

Borrowers can use either all or part of their bond portfolio as collateral to get a cash loan through cash for bond lending. The ability for borrowers to get a cash loan quickly is a major benefit of the money-for-bond lending structure.

Is a bond preferable to a loan?

Funding for a loan comes from a lender, such as a bank or particular company. Businesses raise money by selling bonds to the general public. Either way, the company usually has to pay back the loan with interest that has already been set. First off, the interest rate on bonds is typically lower than that of loans.