If you are looking for Grace Loan Advance reviews, but doubtful of the reliability and safety?

In this article, we will provide everything about Grace Loan Advance you should know!

Table of Content

- What is Grace Loan Advance

- Benefits of Choosing Grace Loan Advance for Personal Loans

- Services Provided by Grace Loan Advance

- Areas Where Grace Loan Advance Falls Short

- Unique Features of Grace Loan Advance

- Pros and Cons of Grace Loan Advance

- Interest Rates and Loan Calculations at Grace Loan Advance

- Personal Loan Requirements at Grace Loan Advance

- Applying for a Loan with Grace Loans Advance

- Comparison of Grace Loan Advance with Other Lenders

- Customer Reviews and Complaints about Grace Loan Advance

- Repaying Loans from Grace Loan Advance

- Grace Loan Advance in 2024: Legitimacy or Scam?

- Conclusion

- FAQs

What is Grace Loan Advance?

Grace Loan Advance is a company that offers a quick and straightforward lending process for personal loans to borrowers with bad credit. The loans come with hefty fees and APRs, but they also give you up to 60 days notice before payments are due. This can be beneficial for borrowers who require some time to organize their finances.

Why get a Personal Loan from Grace Loan Advance?

A compelling feature of Grace Loan Advance is that it allows you to obtain a loan with a maximum amount of $100,000. This is a pretty good range of options that aren’t offered by many larger financiers. The application process can be finished online, and if approved, your funds will be transferred quickly into the bank account of your choice.

If you are having trouble paying off large debts, National Debt Relief, a debt relief company, may be able to help. They can help you save an average of 30% of your total amount owed.

What does Grace Loan Advance offer?

Grace Advance offers personal loans with amounts ranging from $100 to $35,000. The loan amounts increase by $500 every $500, so if you want to borrow $2,800, you will need to take out a $3,000 loan.

There is no grace period for personal loans. This implies that even if you miss your first payment for a few weeks or months, interest will still be charged on your loan and accumulated immediately.

Where Grace Loan Advance is insufficient?

The biggest drawback of Grace Loan Advance’s online operation is its lack of transparency. Specific information regarding eligibility requirements, late or additional loan fees, and company background is not available on its website.

Furthermore, Grace Loan Advance is not a Better Business Bureau (BBB) accredited company. Borrowers might choose to work with a company that has been evaluated by the Better Business Bureau, especially since many lenders are accredited by the BBB.

While there are no fees associated with using Grace Loan Advance’s services, borrowers should be prepared for fees from its network lenders, which aren’t revealed until after a loan is approved.

Customers complain about getting too many promotional emails from lenders both before and after they finish their application process in the scant reviews that can be found online.

What sets Grace Loan Advance apart?

There is no direct lender like Grace Loan Advance. Rather, it provides borrowers of all credit types with a range of lender options. If approved, its application provides a simplified process to get funds to you as soon as the following day.

While many direct lender competitors have starting APRs closer to 7.99%, Grace Loan Advance claims to have competitive starting rates for the best credit borrowers at 5.99% APR.

Pros & Cons of Grace Loan Advance

Its customer reviews indicate that this lender carries its pros and cons.

Pros

Grace Loan Advance BBB suggests the following benefits:

- Low APRs available to qualified borrowers

- Considers applicants with fair credit

- Funding is available within 1 business day

- Flexible repayment terms

- Online application process

Cons

However, Reddit reviews for Grace loan advances highlight the many drawbacks the lender offers its borrowers;

- High interest rates for people with bad credit.

- Not a Better Business Bureau (BBB) Accredited Company.

- Qualifying for a loan can be difficult.

- Not available in every state.

- Limited company and eligibility information is available on its website.

Grace Loan Advance Interest Rate and Loan Calculation

The personal loan offered by this lender may have an interest rate that varies from 5.99% to 35.99% APR based on your credit score and other variables. The interest rate and any other costs related to the loan are included in the annual percentage rate or APR. You can most likely get a better interest rate if your credit is good.

Even so, even those with poor credit might be eligible for a personal loan from it, albeit at a higher interest rate.

Example of Grace Loan Advance Calculation

Here’s an example of how to figure out this loan:

- Loan amount: $10,000

- Grace period: 30 days

- Interest rate: 8%

- Loan term: 60 months

Step #1: Calculate the interest payment due for every month. This is calculated by dividing the loan amount by the number of months in a year and multiplying the result by the interest rate.

- Monthly interest payment calculated as (12 months/year) / (loan amount* interest rate).

- Interest paid monthly is equal to (10,000*8%) / (12 months/year), or $66,67.

Step #2: Calculate how many days remain in the grace period.

- There are thirty days in the period.

Step #3: Calculate the grace loan amount. The monthly interest payment is multiplied by the number of days in the period to achieve this.

- Loan: ($2,000,10 = (monthly interest payment number of days in period) / ($66,67 30 days)

The borrower would be given a loan of $2000,10 in this instance. Throughout the loan’s grace period, this would be used to pay the interest. The borrower would be in charge of making the loan’s regular monthly payments after the term ended.

Grace Loan Advance Personal Loan Requirements

The requirements for a Grace personal loan are as follows:

- Age requirement: 18 years or older.

- Must be a citizen or lawful permanent resident of the US.

- Presently employed or getting a reliable source of income.

- To receive the money, you must have a bank account—ideally with direct deposit.

- A valid driver’s license or other form of identification issued by the government is required.

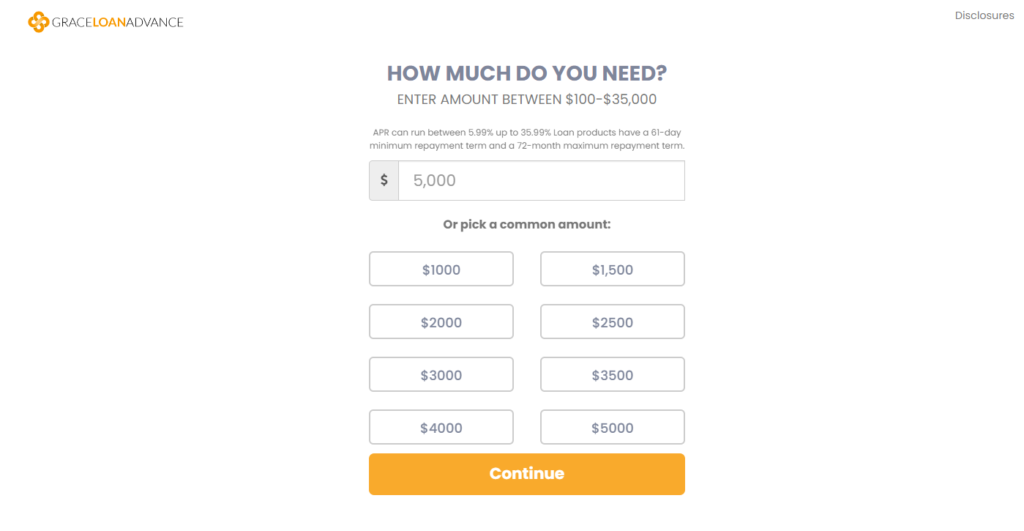

How to Apply for Grace Loan Advance

Here is the simple process of applying for a Grace Loan Advance:

Step #1: Visit the official website

Go to the official website of a Grace Loan Advance

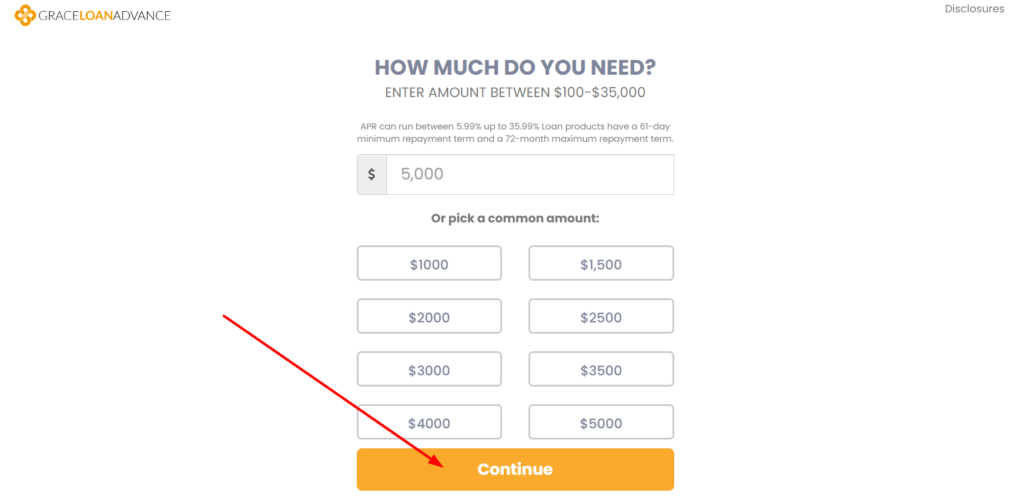

Step #2: Continue your request

- Choose the amount, you want to get

- Next, click the “Continue” button to move forward

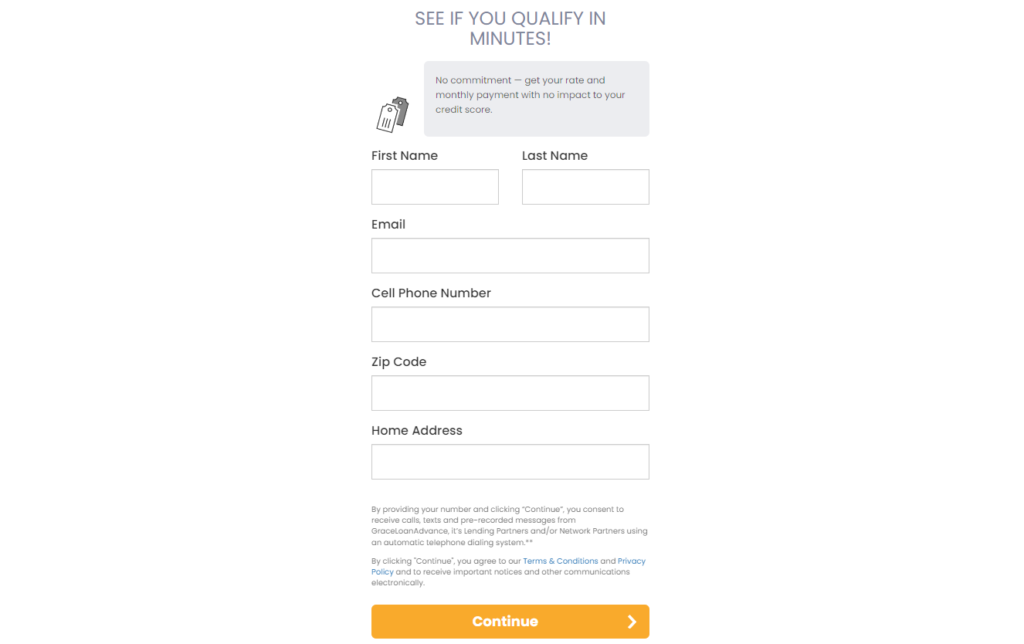

Step #3: Provide your information

- Complete the requirements of providing personal information.

- Continue to provide other relevant information.

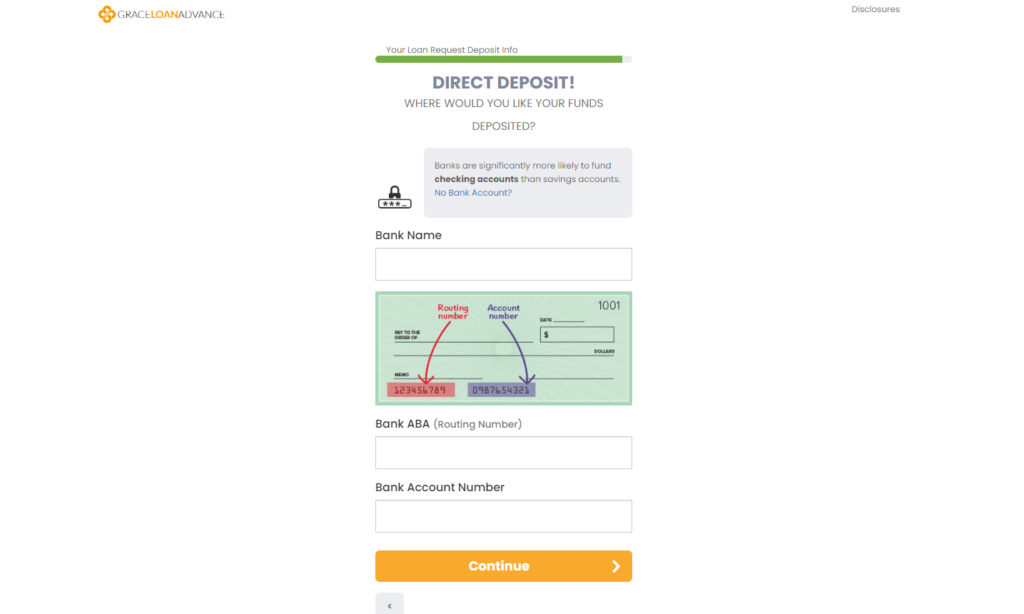

Step #4: Give your bank details

- Provide your Bank name, routing number, and account.

- Continue and follow the next steps to get this loan.

How Grace Loan Advance compare to other lenders

Compare the features, terms, and rates of Grace Loan Advance with those of other well-known personal loan providers.

| Name | APR | Min. credit score | Loan amount | Details |

|---|---|---|---|---|

Best Egg personal loans | 8.99% to 35.99% | 640 | $2,000 to $50,000 | Fast and easy personal loan application process. See options first without affecting your credit score. |

| Upstart personal loans | 7.80% to 35.99% | 300 | $1,000 to $50,000 | This service looks beyond your credit score to get you a competitive-rate personal loan. |

| SoFi personal loans | 8.99% to 29.99% | 680 | $5,000 to $100,000 | A highly-rated lender with competitive rates, high loan amounts and no required fees. |

| Upgrade | 8.49% to 35.99% | 620 | $1,000 to $50,000 | Check your rates with this online lender without impacting your credit score. |

| LendingPoint personal loans | 7.99% to 35.99% | 620 | $2,000 to $36,500 | Get a personal loan with reasonable rates even if you have a fair credit score in the 600s. |

| Happy Money | 11.72% to 24.50% | 640 | $5,000 to $40,000 | Pay down your debt with a fixed APR and predictable monthly payments. |

Grace Loan Advance Reviews and Complaints

| BBB accredited | No |

|---|---|

| BBB rating | NR |

| BBB customer reviews | BBB Accredited |

| Trustpilot Score | Grace Loan Advance does not have any Trustpilot reviews. |

| Customer reviews verified as of | 02 March 2024 |

Grace Loan Advance is not listed as an accredited business by the Better Business Bureau, and it has not received a Trustpilot review. Because of this, it is challenging to predict what a Grace Loan Advance may entail.

On BestCompany, however, the marketplace receives a one out of five-star rating from the scant customer reviews. Clients report that both before and after completing the application process, they received a ton of marketing emails from their partner lenders.

Grace Loan Advance Loan Repayments

You can repay your loan payments to Grace Loan Advance by phone, or by email:

1. Phone payment

- Step #1: Call this lender at (424) 317-8925.

- Step #2: Give your account number and the desired payment amount to the customer support agent.

- Step #3: Pay by debit card, credit card, or bank account.

2. Mail payment

- Step #1: Make Grace Loan Advance the beneficiary of the check or money order.

- Step #2: Add the amount you are paying as well as your account number.

- Step #3: Send payment to Chatsworth, California, 91317, PO Box 9077.

Grace Loan Advance Reviews 2024: Is it Legit or Scam?

Because of its scant online information, borrowers may feel more comfortable selecting more dependable options from BBB-accredited lenders with stellar reviews, even though it may offer loans through its partners.

Conclusion

In the end, Grace Loan Advance gives fast personal loans, especially for people with bad credit. But be careful of expensive fees, changing APRs, and no clear information. Look at other lenders with good reputations and simple terms before deciding.

FAQs

What are the maximum and minimum loan amounts offered by Grace Loan Advance?

$100 to $35,000.

How quickly can funds be transferred into your bank account after approval?

As soon as the next business day.

What is the typical APR range for loans from Grace Loan Advance?

5.99% to 35.99% APR.

Does Grace Loan Advance require collateral for its personal loans?

No, it does not require collateral.

Are there any fees associated with applying for a loan with Grace Loan Advance?

No fees for using their services, but potential fees from network lenders.

What are the eligibility criteria to qualify for a personal loan with Grace Loan Advance?

Must be 18+, US citizen or permanent resident, employed, have a bank account.

Does Grace Loan Advance offer a grace period for missed payments?

No grace period mentioned; interest accrues immediately on missed payments.

Is Grace Loan Advance accredited by the Better Business Bureau (BBB), and what is its current rating?

Not BBB accredited; no current BBB rating available.

What sets Grace Loan Advance apart from other lenders in terms of its loan application process?

Offers a simplified online application process with multiple lender options.

How does Grace Loan Advance handle customer complaints and feedback?

Limited online reviews; feedback suggests issues with excessive marketing emails and transparency.