Best Peer-to-Peer Personal Loan Lenders for 2024: Best Picks for Easy Borrowing

Prosper Personal Loans

Prosper Personal Loans

- APR: 8.99% to 35.99%

- Loan Purpose: Home improvement, debt consolidation, health care, auto, and more

- Loan Amounts: $2,000 to $50,000

- Terms: 24-60 months

- Credit Needed: 640+

- Fees: 1% to 9.99% (deducted from loan); no early payoff penalty

- Pros: Co-borrowers allowed, no prepayment penalty, flexible payment dates

- Cons: High origination and late fees that are subtracted from the loan

Best For: Borrowers needing co-signers or fast funding (next business day).

Upstart Personal Loans

Upstart Personal Loans

- APR: 7.8% – 35.99%

- Loan Purpose: Debt consolidation, weddings, health care, and more

- Loan Amounts: $1,000 to $50,000

- Terms: 36 or 60 months

- Credit Needed: 300+ or no credit history

- Fees: 0% to 12%, no early payoff penalty

- Pros: Accepts low/no credit scores, fast funding (next business day)

- Cons: High costs—$10 for paper copies of the loan contract, for example

Best For: People with low or no credit score.

Kiva Loans

Kiva Loans

- Type: Peer-to-peer crowdfunded loans

- Loan Amounts: $1,000 to $15,000

- Terms: Up to 3 years

- Credit Needed: None

- Pros: 0% interest, ideal for unbanked borrowers

- Cons: Must invite friends/family to lend, slow funding process

Best For: Small business owners seeking no-interest loans.

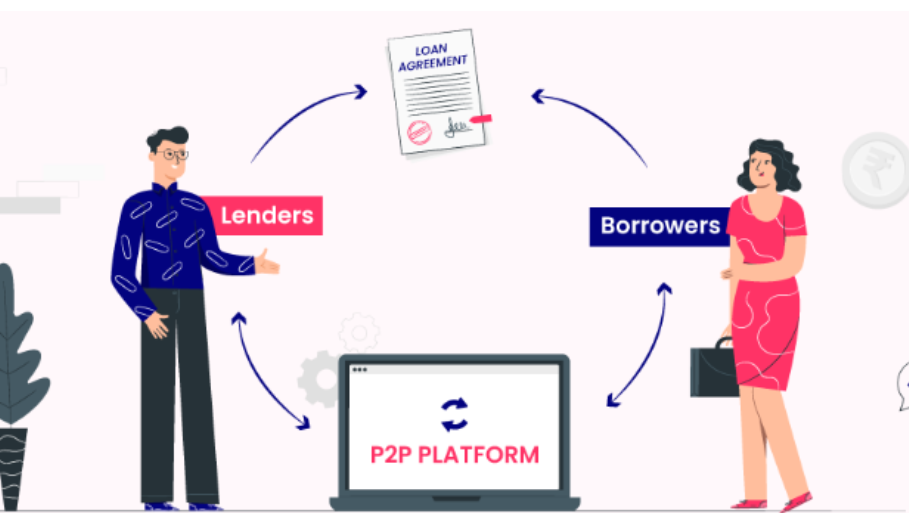

What is Peer-to-Peer (P2P) Lending?

P2P lending enables a borrower to obtain funds directly from an individual or groups of individuals by bypassing the financing route through a bank or any other financial institution. A rapid expansion in recent years of numerous websites providing P2P lending has significantly increased its usage as a new form of financing.

P2P lending is sometimes referred to as “crowd lending” or “social lending.” Among many others, Funding Circle, Kiva, LendingClub, Prosper, and Upstart are leading companies in this field.

Main Takeaways

- People can lend money to or take money from other people without having to visit a bank thanks to peer-to-peer (P2P) lending.

- Most investors in P2P lending are individual investors who broadly require a better return on their savings in cash than they would earn from a bank account or money market fund.

- P2P borrowers demand an alternative to the traditional bank or a lower interest rate than they might get at one.

- The default rates of P2P loans are generally very much more enticing than in the traditional lending system.

- Fees are also assessed by P2P lending platforms to lenders or borrowers, or occasionally to both.

How Peer-to-Peer Lending Works

P2P lending interconnects individual borrowers with individual lenders. However, the rates and terms are different on every platform. Most websites charge different interest rates for every applicant depending on their creditworthiness.

Normally, the investor would first open an account on the website and put in deposits to fund the loans. loan seekers will publish a profile of their financial status and be categorized in a risk class. This then establishes the interest rate at which you can lend them money.

The applicant then gets loan offers from one or more investors and accepts one of them. Some applicants split their requests into chunks and take a few offers. The platform makes it easier for the borrower to receive money and for the lender to receive monthly loan payments. A process can be automated, but lenders and borrowers may also choose to negotiate.

Some sites target a specific class of lenders or loans. Funding Circle, for example, loans only to small business borrowers.1 Kiva is a not-for-profit group where investors may lend to entrepreneurs and other persons in the U.S. and abroad, many who have no access to normal lenders. LendingClub has a “Patient Solutions” segment offering loans and financing plans for medical and dental services.3

History of Peer-to-Peer (P2P) Lending

P2P lending, as it exists today, was first conceptualized in the year 2005.4 It was used to open up opportunities for credit to people shunned by mainstream financial houses as well as individuals who wish to consolidate their student loans to pay them off at a lower interest rate.

P2P lending sites have gained popularity lately, however. Now some of them focus on consumers who tend to pay off their credit card debt at lower interest. Home improvement loans and auto financing are other products offered on the site.

The current interest rates for good-credit applicants are probably lower than equivalent bank rates. Rates may go much higher, however, if an applicant’s credit record has a suspect label. For instance, LendingTree.com quoted rates on personal loans at a range of peer-to-peer sites in August 2024 from less than 8% to almost 36%.5 To put this in perspective, the most current consumer credit report from the Federal Reserve was issued in May 2024 for interest rates that averaged 21.5 percent on credit cards, and 11.9 percent on 24-month personal loans.6

P2P lending has emerged as a source of interest income on their money for the providers of capital at a level higher than what savings accounts or CDs are offering, though without the usual government guarantees those generally entail.

Some of the P2P sites have allowances for lenders to start with a balance as low as $25.

Pros and Cons of peer-to-peer loans

Pros of Peer-to-Peer Lending

- Peer-to-peer loans are also far cheaper than credit cards. A lower interest rate will save a higher amount on the total price of the loan over a longer period.

- Peer-to-peer loans typically need to be repaid in a shorter term-one, three, or five years. This pays off your debt faster because the term periods are much shorter than other types of loans (up to seven years for personal loans).

- The application and funding process may be quicker compared to other kinds of loans. Peer-to-peer lending can qualify borrowers with a poor or limited credit history.

Cons of peer-to-peer lending

- This may enable you to pay off the debt faster, but the terms of repayment with limitations are unappetizing to borrowers since this implies that they would prefer paying in more installments over time and getting smaller monthly payments to fit into their budget.

- As a result, many peer-to-peer loans cost more in fees than traditional personal loans. You may be charged a closing fee to fund on a peer-to-peer loan, though this again depends on the funding institution to which you apply.

Best Peer-to-Peer Loan Alternatives in 2024

LendingClub Credit

LendingClub Credit While it still provides personal loans, LendingClub ceased to provide peer-to-peer loans in 2020. It’s a good choice if you want to consolidate debt, as it sends funds directly to your creditors, saving you the hassle.

- Loan Amounts: $1,000 to $40,000

- Loan Terms: 24 to 60 months

- APR: 8.98% to 35.99%

- Origination Fee: 3% to 8% of loan amount

- Prepayment Penalty: None (you can pay early with no fees)

- Late Fee: 15-day grace period

Joint Applications: You can apply with a co-borrower, which may help lower your interest rate.

Other Alternatives

- Borrow from Family or Friends: If you’re in a financial emergency, friends or family might be able to help without strict terms.

- Credit Cards: Consider credit cards with low or 0% intro APR offers if you need short-term help.

- Wells Fargo Reflect® Card

- Intro APR: 0% for 21 months on purchases and balance transfers

- Regular APR: 18.24% to 29.99%

- Balance Transfer Fee: 5% (min. $5)

- Annual Fee: $0

- Credit Needed: Excellent/Good

These options may help if you prefer flexible, shorter-term solutions or need quick access to funds.

Conclusion

Peer-to-peer lending sites provide borrowing services to entrepreneurs, small business owners, and any other person who is not a perfect applicant according to the requirements of banks.

While P2P lenders do seem pretty lenient on credit, this again comes with a greater fee or interest for borrowers and a riskier investment opportunity for lenders. One good reason to read through the terms is the ease by which many offer to invest or borrow.

FAQs

What is peer-to-peer lending?

Peer-to-peer lending thus gives you a loan from another person. Normally, with any direct loan, you will apply for funds directly through a financial institution and the institution will directly fund you. In peer-to-peer lending, however, the institution only facilitates your funding and will not provide it.

Is Peer-to-Peer Lending (P2P) Safe?

Peer-to-peer lending is a bit riskier than putting your money in the bank, but often the interest rates are much, much higher. This is because investors through peer-to-peer lending sites bear most of the risks while working without any kind of guarantee that they can expect from a bank or the Federal Deposit Insurance Corporation.

How low of a credit score is needed to apply for a peer-to-peer loan?

Generally, platforms require a minimum credit score for peer-to-peer loans, so the higher your credit score, the more likely you are to be approved for some of the best available terms.

How large is the peer-to-peer (P2P) lending market?

Peer-to-peer lending was estimated to be worth $5.94 billion globally in 2023 and is projected to grow to $30.54 billion by 2032, according to data from SNS Insider.

How to Invest in Peer-to-Peer Lending?

The most direct approach to start investing in P2P lending is to open an account on the P2P lending website, deposit some money into it, and then start lending.

These websites often allow the lender to decide on the profile of the type of borrower that they would like to fund, so they may choose to take high risk with potentially high rewards or lower risk with more modest returns.

Alternatively, many P2P lending sites are public companies; therefore, you can also invest in them by buying their stock.